|

Currency market basics: how the global currency markets work

|

| The currency market is the largest and most liquid financial market in the world, but also one of the least known. Currencies like the U.S. dollar, the euro and the yen trade in the foreign exchange (FX) market 24 hours a day across national borders.

|

| Overview of the global currency markets |

Currency in its simplest form describes the money or official means of payment in a country or region. The best known currencies include the U.S. dollar, euro, yen, British pound and Swiss franc. A commonly used currency symbol exists for many currencies, for example $, £ or €. FX markets, however, use so called ISO codes, for example USD for U.S. dollar, GBP for the British pound and EUR for the euro.

Every day more than U.S. $3 trillion in currencies change hands in a highly professional interbank market, in which electronic trading platforms link currency traders from banks across the world directly. FX markets are effectively open 24 hours a day thanks to global cooperation among currency traders. At the end of each business day in Asia, traders pass their open currency positions on to their colleagues in Europe, who – at the end of their business day – pass their open positions on to American traders, who just begin their working day and pass positions on to Asia at the end of their business day. And there, the circle begins anew. This makes FX truly global and very liquid.

|

|

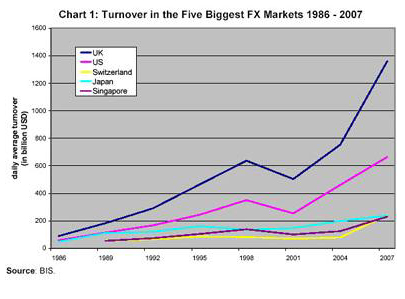

| Around the turn of the century, trading volumes increased dramatically, as Chart 1 shows. The Bank for International Settlement (BIS) identified several factors responsible for the increase in currency trading at the time. First, higher volatility and clear trends in FX markets made currency a potentially attractive investment. Second, interest rate differentials between countries were prompting market participants to exploit these differentials with different strategies. The most famous of these strategies has become the Carry trade, which we will explain in more detail later. Third, the global search for yield was boosting interest in FX as an alternative to stocks and bonds.

|

| Exchange rate |

| The exchange rate is a price - the number of units of one nation’s currency that must be surrendered in order to acquire one unit of another nation’s currency.

|

| A List of factors which determine currency value |

| What determines the value of a countries currency really comes down to supply and demand of that currency. If a particular country’s currency is in high demand by purchasers such as travelers, governments, and investors, it will increase the value of that country’s currency. The factors that follow may have a positive or negative effect on the demand for a particular currency.

|

| 1) Printing of currency |

| If a country prints an excessive amount of currency, more then what it normally would, this can decrease the value of the currency. A large amount of currency in circulation can lower the value of a currency. A small amount of currency in circulation can result in the value of the currency increasing.

|

| 2) Current state of the economy |

| If a country’s economy is not doing well, this can decrease the demand for that countries currency. Specifically, here we are talking about the degree of unemployment, degree of consumer spending, and extent of business expansion that is taking place in a country. High unemployment, decrease consumer spending, with a decrease in business expansion, means a poor economy and a decrease in currency value.

|

| The potential for economic growth in a country should also be looked at. If the potential is strong, then it's currency value would expect to increase. Also, if a country produces products that other countries want to buy, it can increase the value of that country’s currency.

|

| 3) Prices of foreign goods |

| Prices of foreign goods is related to the economy. If a foreign company sells goods in a country which are cheaper then comparable products produced in that country, it can hurt the economy of that country. A poor economy results in a decrease in demand for that country’s currency, which lowers its value.

|

| 4) Political conditions of a country |

| A country which is known to have corrupt politicians, can result in a lowering of the value of its currency

|

| 5) How secretive is a country |

| A country which operates at a high level of secrecy, atleast as observed by those outside the country, can result in a lowering of the value of their currency.

|

| 6) National debt of a country |

| In a democratic society, national debt must be paid by the taxpayer. If taxes increase, this results in a lowering of the purchasing capability of society, which results in a deleterious effect on the economy. In this case, currency value will decrease.

|

| 7) Presidents popularity |

| If a president is popular, this can increase the demand for a currency. If the president’s popularity is dropping, due to unpopular government policies, this may result in a decrease in demand for a currency and a subsequent lowering of its value.

|

| 8) War and terrorists attacks |

| A terrorists attack can increase the probability of a war. A war or the strong potential for a war can decrease the demand for a currency, simply because a war drains the economy. Wars are expensive and must be paid by the taxpayer. So war lowers the value of a currency.

|

| 9) Government growth |

| Excess government growth can lower the value of a countries currency. Again, the taxpayer will need to pay for the new growth, which for the long run has a negative effect on the economy.

|

| 10) Tax cuts for the consumer |

| Tax cuts can stimulate the economy, as long as the consumer spends the extra money he or she may have. But also, tax cuts which are to large can result in high demand for products, which may raise prices, which can lead to inflation and the desire to purchase cheaper foreign products. But in general, tax cuts historically have been good for the economy, which can result in an increase demand for that countries currency.

|

| 11) Interest rates |

| A higher interest rate means a higher demand for a currency. Foreign investors in a currency prefer a higher interest. This increase in demand for a currency results in an increase in its value.

|

| 12) Housing market |

| If there is a slowing of a housing market, it means that the seller’s asking price will be less, resulting in less consumer spending. This has a negative effect on the economy. Again, poor economic conditions result in a lower demand for the currency, thereby lowering its value.

|

| 13) Positive or negative perception |

| How purchasers of a currency perceive the previous discussed parameters, can determine the degree of demand for a currency. Whether or not the perception is accurate is not as important as what the perception itself is. Perception is what determines if a currency purchaser decides to buy or sell a currency.

|

| To conclude, the factors presented here are determinants of the degree of demand on a currency, and therefore its value. There are other factors such as manufacturing growth, degree of entrepreneurship in a country, employment growth, and even the weather and its effect on the agricultural industry, energy consumption, and local economies. These also can determine the demand for a currency. The factors listed here determine the perception that a potential buyer of currency may have. How a potential buyer of a currency looks at a particular country using these parameters, will determine the demand on the currency, and ultimately its value.

|

| Economic variables which affect foreign exchange market |

| Interest rates, inflation, and GDP numbers are the main variables; however other economic indicators such as unemployment rate, bop, trade deficit, fiscal deficit, manufacturing indices, consumer prices and retail sales amongst others.

|

| News and information regarding a country's economy can have a direct impact on the direction that the country's currency is heading in much the same way that current events and financial news affect stock prices, hence the importance of economic factors. The following eight economic factors will directly affect a currency's movements in the Forex market.

|

Interest rates, inflation, and GDP numbers are the main variables; however other economic indicators such as unemployment rate, bop, trade deficit, fiscal deficit, manufacturing indices, consumer prices and retail sales amongst others.

News and information regarding a country's economy can have a direct impact on the direction that the country's currency is heading in much the same way that current events and financial news affect stock prices, hence the importance of economic factors. The following eight economic factors will directly affect a currency's movements in the Forex market.

Factor 1 - employment data

Strong decreases in employment indicate a contracting economy, while strong increases are perceived indicators of a prosperous economy.

Factor 2 - interest rates

This is always a major focus in the forex market. Since the central banks mandate monetary policy and supply, they are the prime focus of investors and the various market participants.

Factor 3 – inflation

This is the measure of increases or decreases in pricing levels over a period of time. Due to the immense number of goods and services available in a country, usually a grouping of these goods and services are used to measure changes in the pricing. Increases in pricing indicate an increase in the inflation rate which in turn can devalue that country's currency.

Factor 4 - gross domestic product is the measurement for goods and services that were finished over a period of time. The GDP is broken down into 4 categories:

- Business spending

- Government spending

- Private consumption

- Total net exports

Factor 5 - retail sales

The measurement of sales recorded by retailers over a period of time is a reflection of either increased or decreased consumer spending, depending on whether sales are up or down for the comparative period a year ago. This indicator gives market participants an idea as to how strong or weak the economy is.

Factor 6 - durable goods

Goods that have a lifespan of three or more years are considered durable goods and they are measured in quantities that are ordered, shipped, or unfilled over a period of time. These are also an indicator of economic spending or the lack of it.

Factor 7 - trade and capital flows

Currency values can be significantly impacted by monetary flows that result from certain interactions between countries. When imports exceed exports, there is a tendency for the currency value to decline. Increased investments in a country can lead to the opposite result.

Factor 8 - macroeconomic and geopolitical events

Elections, financial crises, monetary policy changes, and wars can influence the biggest changes in the Forex market. These events can either change and/or lead to reshaping of a country's economy.

|

| Currency derivatives |

Currency futures: A currency futures contract is an agreement between two parties to buy or sell a currency at a certain time in the future at a certain price. In India, one can trade in USDINR, EUROINR, GBPINR and JPYINR currency futures.

Currency options: Currency Options are of two types - calls and puts. Calls give the buyer the right but not the obligation to buy a given quantity of the underlying asset, at a given price on or before a given future date. Puts give the buyer the right, but not the obligation to sell a given quantity of the underlying asset at a given price on or before a given date. Currently, currency options are available only for USDINR.

|

| Major market participants |

- Hedgers

- Speculators

- Arbitrageurs

|

| Various terminologies in currency market |

Spot price: The price at which a currency trades in the spot market. In the case of USD/INR, spot value is T + 2.

Futures price: The price at which the futures contract trades in the futures market.

Contract cycle: The currency futures contracts on the SEBI recognized exchanges have one-month, two-month, and three-month up to twelve-month expiry cycles. Hence, these exchanges will have 12 contracts outstanding at any given point in time.

Final settlement date: The last business day of the month will be termed the Value date/ Final Settlement date of each contract.

Expiry date: It is the date specified in the futures contract. All contracts expire on the last working day (excluding Saturdays) of the contract months. The last day for the trading of the contract shall be two working days prior to the final settlement date or value date.

Contract size: In the case of USD/INR it is USD 1000; EUR/INR it is EUR 1000; GBP/INR it is GBP 1000 and in case of JPY/INR it is JPY 100,000. ( Ref. RBI Circular: RBI/2009-10/290, dated 19th January, by which RBI has allowed trade in EUR/INR, JPY/INR and GBP/INR pairs.)

Basis: Basis can be defined as the futures price minus the spot price. In a normal market, basis will be positive. Futures prices normally exceed spot prices.

Cost of carry: The relationship between futures prices and spot prices can be summarized in terms of what is known as the cost of carry. This measures (in commodity markets) the storage cost plus the interest that is paid to finance or ‘carry’ the asset till delivery less the income earned on the asset. For currency derivatives carry cost is the rate of interest.

Initial margin: The amount that must be deposited in the margin account at the time a futures contract is first entered into is known as initial margin.

Marking-to-market: In the futures market, at the end of each trading day, the margin account is adjusted to reflect the investor's gain or loss depending upon the futures closing price which is known as marking-to-market.

|

| Advantages of currency futures |

- Transparency and efficient price discovery

- Elimination of Counterparty credit risk

- Access to all types of market participants

- Transparent trading platform

- Surveillance.

|

| Contract specifications for currency futures |

|

|

| Hedging |

Currency hedge:

In equities, the act of holding a position in a stock denominated in a foreign currency while holding an equal but opposite position in the currency itself. This protects the investor from fluctuations in the value of a currency adversely affecting the stock holdings.

How hedging is useful for an importer:

The importers need to pay for the imports in terms of USD/EURO/GBP/JPY. The risk of importers is the appreciation of USD against INR. In this case they need to shell out more money in terms of INR for the same imports.

The importer’s risk can be hedged using currency derivatives by taking LONG positions in the currency futures/options (call option long position) market.

Hedging exposure by an importer through currency derivatives:

Scenario 1: A chemical importer wants to import chemicals worth USD 1000 and places his import order on November 15, 2010, with the delivery being 2 months ahead. At the time when the contract is placed, in the spot market, one USD was worth say INR 45.10. But, suppose the Indian Rupee depreciates to INR 46.75 per USD at time of payment which is due in January 2011. So, the value of the payment for the importer goes up to INR 46,750 rather than INR 45,100. The hedging strategy for the importer, thus, would be:

Using currency futures:

|

| Current Spot Rate (Nov 15 2010) |

45.1000 |

| Buy 1 lot USDINR Jan'11 Contract on 15th Nov '10 |

(1000 * 45.60) * 1 (Assuming the Jan '11 contract is trading at 45.6000 on 15th Nov '10) |

| Sell 1 lot USDINR Jan '11 Contracts in Jan '11 Profit/Loss (futures market) |

46.7500 1000 * (46.75 – 45.60) * 1 = 1150 |

| Purchases in spot market @ 46.75 Total |

46.75 * 1000 |

| cost of hedged transaction |

1000 * 46.75 – 1150 = INR 45600 |

|

| So, effectively the importer pays the November price of USDINR January futures which is 45.60. |

Using currency options

Buy 1 lot USDINR Jan'11 Call option @ strike 45.25 on 15th Nov '10 by paying a premium of 0.70 per lot of 1000 USD. Therefore in total he pays a premium of INR 700 for the call option.

In January 2011, since the spot price of USDINR is 46.75, the call option @ strike 45.25 is deep ITM (in-the-money) so the premium is increased to 1.50 per lot of USDINR.

Thus, profit on hedge position is INR 800.

So, he makes a total of INR 800 on his hedge. Effectively his cost of import decreases to INR 45950 (46750-800).

How hedging is useful for an exporter:

The exporters get their export receivables in terms of USD/EURO/GBP/JPY. The risk of exporters is the appreciation of INR against USD. In this case they get less in terms of INR for their exports.

The exporter’s risk can be hedged using currency derivatives by taking SHORT positions in the currency futures/options market (put option long position).

Hedging exposure by an exporter through currency derivatives:

Scenario 2: A textile exporter wants to export textile goods worth USD 1000 and gets his export order on November 15, 2010, with the delivery being 2 months ahead. At the time when the contract is placed, in the spot market, one USD was worth say INR 45.10. But, suppose the Indian Rupee appreciates to INR 44.25 per USD at the time of receipt of payments which is due in January 2011. So, the value of the receivables for the exporter decreases to INR 44,250 rather than INR 45,100. The hedging strategy for the exporter, thus, would be:

Using currency futures:

|

| Current Spot Rate (Nov 15 2010) |

45.1000 |

| Sell 1 lot USDINR Jan'11 Contract on 15th Nov '10 |

(1000 * 45.60) * 1 (Assuming the Jan '11 contract is trading at 45.6000 on 15th Nov '10) |

| Buy 1 lot USDINR Jan '11 Contracts in Jan '11 Profit/Loss (futures market) |

44.2500 1000 * (45.60 – 44.25) * 1 = 1350 |

| Selling in spot market @ 44.25 Total cost of hedged transaction |

44.25 * 1000 1000 * 44.25 + 1350 = INR 45600 |

So, effectively the exporter gets the November price of USDINR January futures which is 45.60.

|

Using currency options:

Buy 1 lot USDINR Jan'11 Put option @ strike 45.0 on 15th Nov '10 by paying a premium of 0.45 per lot of 1000 USD. Therefore in total he pays a premium of INR 450 for the put option.

In January 2011, since the spot price of USDINR is 44.25, the put option @ strike 45.0 is deep ITM (in-the-money) so the premium is increased to 0.75 per lot of USDINR. Thus, profit on hedge position is INR 300.

So, he makes a total of INR 300 on his hedge. Effectively his receivables of export increases to INR 44550 (44250+300).

|

| Arbitrage: |

Arbitrage means locking in a profit by simultaneously entering into transactions in two or more markets. If the relation between forward prices and futures prices differs, it gives rise to arbitrage opportunities. Difference in the equilibrium prices determined by the demand and supply at two different markets also gives opportunities to arbitrage

Profits through arbitrage:

Scenario 1: Assume the spot rate for USD/INR is quoted @ Rs. 45.20 and three months forward is quoted at 86 paisa premium to spot @ 46.06 while at the same time one month currency futures is trading @ INR 45.80.

An active arbitrager realizes that there is an arbitrage opportunity as the one month futures price is less than the one month forward price. He implements the arbitrage trade where he;

Buys in futures @ 45.80 levels (3 months)

Sells in forward @ 46.06 (3 months) with the same term period

In the process, he makes a Net Gain of 46.06-45.80 = 0.26

i.e. Approx 26 Paisa arbitrage

Profit per contract = INR 260 (0.26x1000)

The discrepancies in the prices between the two markets have given an opportunity to implement a lower risk arbitrage. As more and more market players will realize this opportunity, they may also implement the arbitrage strategy and in the process will enable market to come to a level of equilibrium.

|

| Currency trading tools and techniques: |

Technical analysis

To develop a strategy, traders use a variety of tools and techniques. Some traders perform Technical Analysis by using Currency Charts to study the market. This technique assumes that past market movements will help predict future activity. The effectiveness of Technical Analysis makes it a very popular trading technique.

Fundamental analysis

Other traders use Fundamental Analysis for their trading strategy. They follow the effect of economic, social and political events on currency prices. Reading specialized Forex News can help keep you in touch with the Forex community to find out how events might affect currency prices.

Practice and familiarize

Every trader makes mistakes, so it's a good idea to familiarize oneself with a trading environment before investing money. To improve trading skills, a free demo trading account can be opened with a Forex company.

Know the risks

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for everyone. Before deciding to trade foreign exchange investment objectives, level of experience, and risk appetite should be carefully considered. Money that one can afford to lose should only be invested.

|

|